Corruption

and Public Financial Management

By Lalit Kumar.

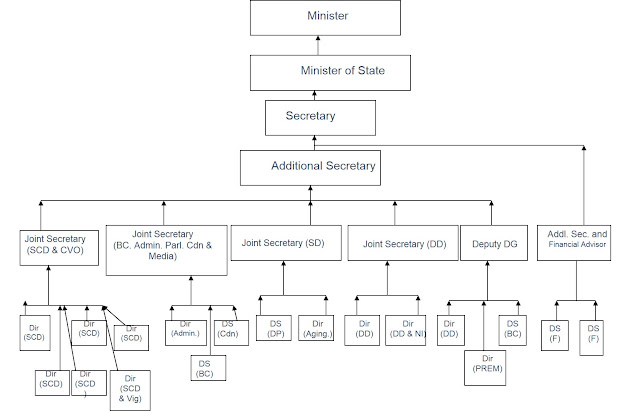

The Government ensures the

administration over citizens as per the rules laid by legislature and provides

the public services, security through armed forces, and justice through

judiciary services. How the Executive System works in Government of India?

The executive system ensures the

control over corruption in providing goods and services through Government

Organizations. It ensures availability of goods and services for fulfillment of

basic needs of the public or citizens. It regulates all sectors of the economy

and also ensures control over the State Governments.

Each State Government further

functions to ensure proper governance in providing goods and rendering public

services:

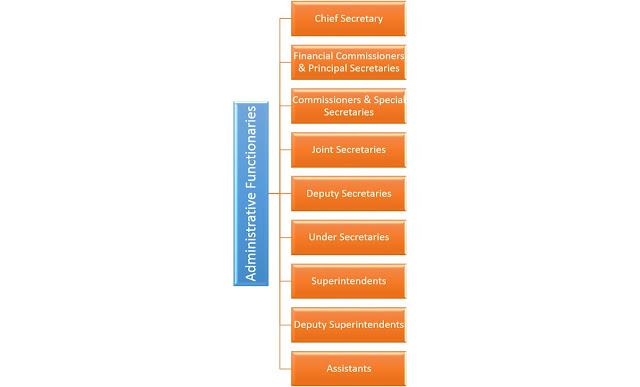

The ultimate goal of political and

administrative functionaries in Centre as well as in States; is to ensure

quality service delivery to the citizens. The Constitution also directs to

fulfill the needs of citizens through political and administrative setup. The

administrative setup includes the following:

The Chief Secretary is the head of

administration and there are Additional Chief Secretaries work under him for

one or multiple Government departments. In most of the States, there is Human

Resource Management System (HRMS) working to establish these functions more

effectively.

Each field office works with

commitment towards achievement of a common goal provided by their

administrative secretaries:

Each field office works towards individual

excellence and with trust over each other to get the benefit of collective

functions. The team-spirit and motivation works in groups and the instructions

are passed by Commissioners and Deputy Commissioners by organizing meetings,

workshops, and giving written directions through orders.

Role of Accounts Administrator:

The role of Accounts Administrator

has become more challenging due to increase in financial irregularities and

involvement of external bodies in ensuring good governance through using

information technology. The corruption is usually originated by involving the

employees of an organization. Earlier it was considered that employees provided

higher salary packages don't make corruption but the scams through involving

banking officers in case of PNB scam and Rotomac scam had proved it wrong. The misuse

of public funds, bribery, and means of abusing office; are most prominent

issues in financial administration for each state government in India. The

Administrative Training Institute (ATI) i.e. Haryana Institute of Public Administration

(HIPA) and the Chief Secretary Office have been putting full efforts to sort

out the problems relating to corruption in public offices. The corruption in

itself contains either the ways to divert public resources for private or

personal uses or abusing of authorities for personal interests.

The Public Financial Management (PFM)

It explains the managerial aspects

relating to acquisition of public resources, safeguarding pubic resources, and

effective & efficient utilization of public resources. It comprises the systems

of revenue collection, assets and debt management, budget preparation and

execution, preparing and maintaining accounts, internal and external control

for effective compliance of budget and audit mechanisms. In case, the PFM is

strongly enforced, there will be very little scope of corruption. In other

words, it is relaxation in PFM that generate the conditions for happening of

corruption.

Wherever the financial rules have not

been defined and enforced; the officers take decisions with their discretion

and such discretion gives scope for corruption. Wherever the control mechanisms

are absent or unavailable, the utilization of resources may lead to corruption

by increasing the probability of individuals to be engaged in corruption

practices like theft, misuse of resources, and abusing powers for personal

interests. Wherever the executives are incompetent or less qualified as per the

requirement; others including employees, citizens, and other stakeholders

become empowered to get benefit from the in-competencies of the

executives. If there is more potential for happening of corruption, then

definitely there is weak public financial management system.

The only key solution to corruption

in public organizations is to develop effective PFM systems, refine PFM

systems, and strengthening transparency, accountability, and enforcement.

Understanding Group Dynamics for Success:

The executives are trusted to perform their duties by taking

work from others. The principle of success in each department is, “You can

accomplish anything in life provided you don’t mind who gets the

credit”. The civil servants are trained in training institutes to share their

abilities to the subordinates and getting work in best ways. They are trained

to make a difference and leave their footprints in the sand for others to

follow.

There are seven Cs to get success in each

government office i.e. Commitment towards Goals, Competence to achieve goals,

Character to stay work hard in office, Compassion to deliver continuous

effective results, Credibility to get the work done from others, Clarity on

what to do and what not to do, and Courage to deliver 100% in each function.

*Copyright © 2018 Dr. Lalit Kumar. All rights reserved.