11 Common Serious Mistakes in Tender

In earlier article Dr. Lalit Kumar explained how to open, evaluate, and award a tender.

Further, he has written this article, we thanks him for giving such good write-up for publication.

The procurement of goods and services is generally noticed as an area

of financial irregularities and embezzlement. Keeping in view, the Government

launched Government e-Marketplace (GeM) for ensuring transparency and making

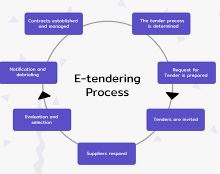

officers directly accountable. The e-Procurement portal is also launched to

ensure the proper procedure of the tendering. In this article, we will go

through the common mistakes usually committed during the procurement. The award

of tender is a lengthy process and requires sincerity at each level:

(i) Availability of sanctions:

The tender process comprises two rounds, technical round and financial

round. For both rounds, the technical and financial sanction of competent

authority is required. Whatever terms and conditions are provided in the tender

document, required to be approved by the Competent Authority. It is required to

get approvals otherwise it will be a mistake and audit objection can be raised.

(ii) Adequate Publicity:

The procuring authorities required to ensure the competition among the

bidders and for this purpose, adequate and wide publicity is required.

Advertisement is posted on website and tender documents are uploaded on

e-procurement portal. It is required to ensure the adequate publicity otherwise

it will be treated as serious mistake audit objection can easily be raised.

(iii) Enough Time for each step of Tender:

The tender is lengthy process and accordingly, the enough time should be

provided for receiving the bids, opening tender after receiving of bids,

addressing the bidders and inviting time to be present during the award of

tender etc. In case, there is not enough time for any particular step, all

process will seam biased and audit objection can easily be raised for the

mistake.

(iv) Establishment of Panel in Limited Tender:

Generally, limited tender is preferred to avoid the delay in procurement

of goods and services. In such circumstances, a panel is established for enrolment

of vendors, contractors, and service providers. The terms and conditions for enrolment

should be transparent and clearly explained on the website. The eligibility

criteria should not be biased and the panel should be updated at regular

intervals keeping in view the enrolment of new vendors. In case, panel is not

established and updated at regular interval, it will be treated as serious

mistake because it will restrict the competition in procurement.

(v) No Deviation in Criteria during Evaluating Bids:

The tender document contains the criteria on which basis the bids are

evaluated. The criteria are conveyed to all bidders through the tender document

and during the evaluation of technical and financial bids, the criteria should

be adopted strictly as provided in the tender document. There should be no

deviation in the criteria so that the bidders feel comfortable with the award

of tender to the successful bidder. In case, there is deviation in criteria

then the whole process is held biased and the unsatisfied bidders can move to

the Central Vigilance Commission (CVC). The CVC considers it a serious mistake

in Tender.

(vi) Verification of Certificates:

The committee should verify the certificates of the bidders during the technical

evaluation of bids. Most of the time, it is found that the certificates

submitted by the bidders are bogus and in such circumstances, the procurement

is required to be revised from new start-up level. Therefore, the certificates

including experience certificate of bidders should be verified seriously. Due

to this mistake, most of the tender are cancelled by the court and CVC.

(vii) Opening Tender in presence of Bidders:

The bidders move to the court for justice only if they are not satisfied

from the process of awarding tender. Therefore, the provision of ensuring

presence of bidders or their authorised representatives is must during the evaluation

of tenders. The tenders should be opened in the presence of bidders or their

authorised representatives. The CVC guidelines strictly suggest to ensure it.

This mistake can be harmful to the whole tender process.

(viii) Numbering and Attestation of pages in Tender:

The price bids submitted by the bidders should be numbered properly and

during opening of the tender, the corrections / omissions / additions etc.

should be numbered and attested by the committee members. Tender opening

register should be maintained. The common mistakes comprise non-numbering of

the corrections and after completion of process, the corrections seem

suspicious.

(ix) No Change in Bids after opening Tender:

The bidders should not be allowed to change any document, certificate,

or condition in the submitted envelopes which may lead to financial

implications.

The mistake of allowing change can be a suffering to the whole process

of tender.

(x) Justification if Tender is not award to Lowest-1:

The tender is required to be awarded only to the lowest-1 bidder that is

the bidder quoted lowest bid for providing goods and services. Only in

exceptional cases, it can be awarded to another bidder. In case, it is done,

the exceptional conditions should be explained properly. Such circumstances may

be ‘procurement of proprietary items’, ‘items with limited sources of supply’,

and ‘where there is suspicion of formulation of cartel.

(xi) Details of Negotiations (if any):

The justification of awarding tender and in case of negotiation at the

time of award of tender should be noted down with recording the facts. There

should be no delay in recording such facts. The mistake of not recording facts

can become harmful for the procuring authorities at later stage.

Copyright © 2019 Dr.

Lalit Kumar. All rights reserved.

You might also be interested in the following:

Types of Tenders in Government

|

Tender and Central Vigilance Commission

|

e-Procurement, Purchase Matters and Inventory Management

|